What is LedgerLoops?

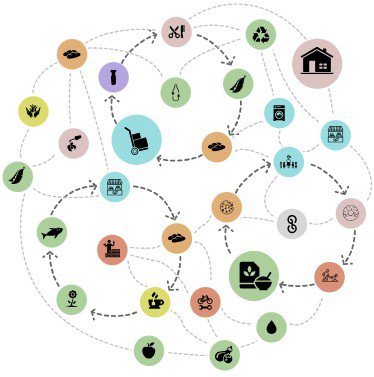

LedgerLoops is a decentralized peer-to-peer obligation clearing network that clears invoices and receipts between ledgers. Move beyond the old-school ways of transferring cash back and forth slowly while waiting to get paid.

LedgerLoops is designed for those who frequently do business with each other. It’s like having a secret handshake that lets you settle your accounts automatically. Gridlocks cause late payment for almost everyone, and we can resolve them.

What’s the secret sauce, you ask? Our cutting-edge algorithm identifies payment loops and cash flow gridlocks, resolving them faster than you can say ‘financial freedom!’ Say goodbye to the days of waiting for payments and hello to a seamless trading experience.